Swing Trade Idea (NVO) – August 15, 2024

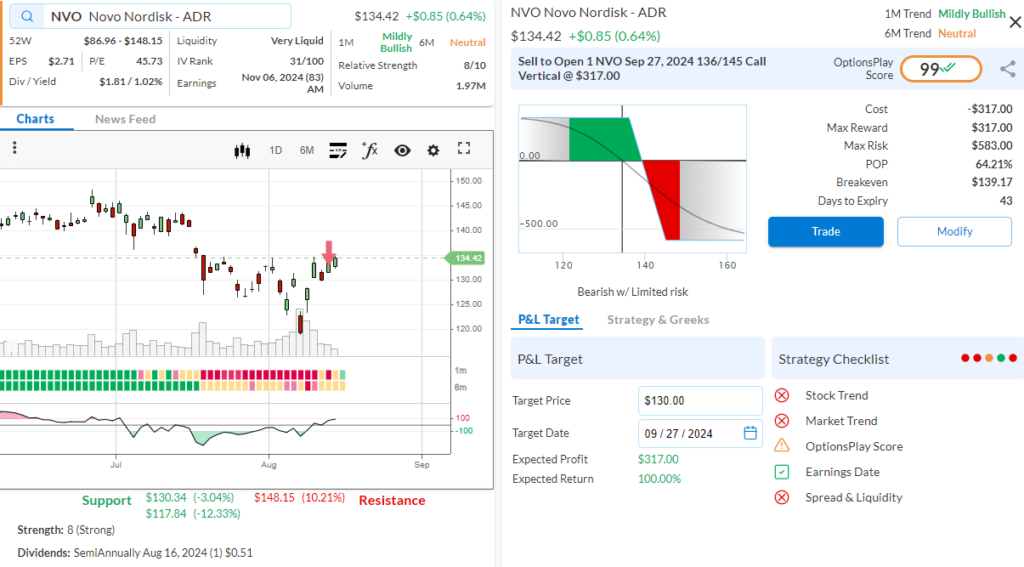

Our bearish trade for Thursday, August 15th is Novo Nordisk (NVO) NVO is part of the Health Care Sector, which performed at 1.27% over the last month. NVO underperformed relative to its sector at -4.58% over the same period.

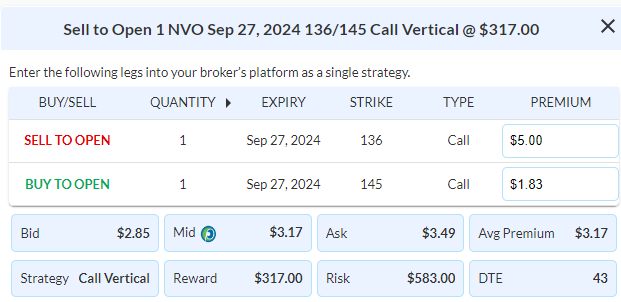

NVO is trading lower after a pullback from its recent highs following disappointing earnings in August. Currently, it is trading around a key area of resistance of $135 while it is losing strength. NVO is therefore likely to continue this pullback towards support at around $120 – $110. We are playing a Credit Spread that collects more than 35% Premium/Width.

As a close, if NVO were to trade above $138 for multiple days, this would invalidate our analysis and we will consider cutting losses on the trade. We will also consider cutting losses on this options trade if the value of the vertical spread moves above $6.34.